Insurance can represent the difference between financial security and destitution. It’s a safety net for the things that are most essential in life, health, travel, and shelter, to start. Health insurance in particular is an unavoidable cost of living in places like the United States.

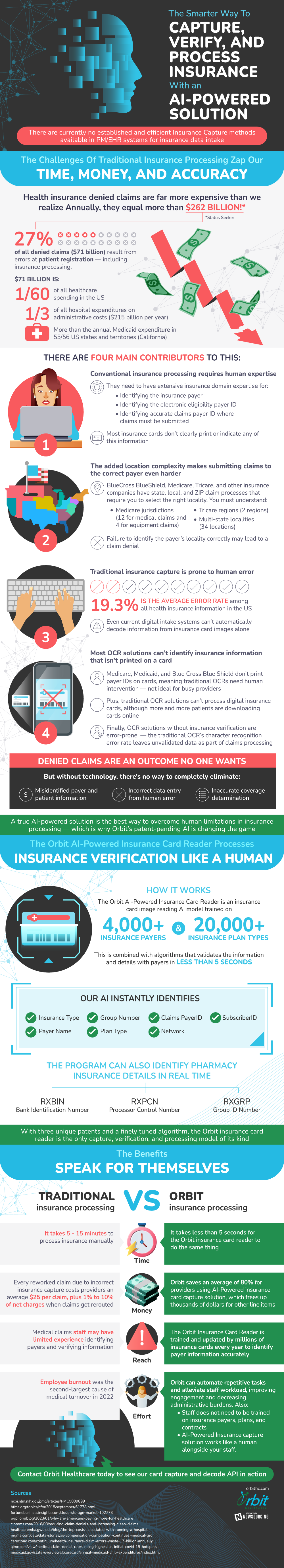

It’s essential then that having health insurance actually equates to insured hospital bills. Of course, more expensive insurance will have more extensive coverage, although almost a third of denied claims come from error. This can come from the person trying to make the claim entering improper information or submitting to the wrong location. It can also come from improper digital capture of health insurance information

There’s no worse feeling than receiving a denied claim due to simple human error. This is especially true when one realizes these errors are typically due to a lack of knowledge. Digital capture of insurance, which has massively boomed lately, is an attempt at fixing this issue. Yet the real innovation as of late is AI-powered insurance capture and verification.

These card readers, services like Orbit, are trained explicitly on insurance. What this means is instead of attempting to read text itself, these services will be looking for actual insurance information. Insurance plans, locations, group numbers, and networks are all explicitly recognized and documented.

In terms of outcome this massively boosts consistency and reliability of insurance capture. And that, in turn, makes it so that any human or digital errors are massively reduced. This is the most pivotal step forward in reducing underserved denied insurance claims. Reducing this saves payers and claimers alike money, reducing time and effort spent resubmitting claims.

Source: OrbitHC